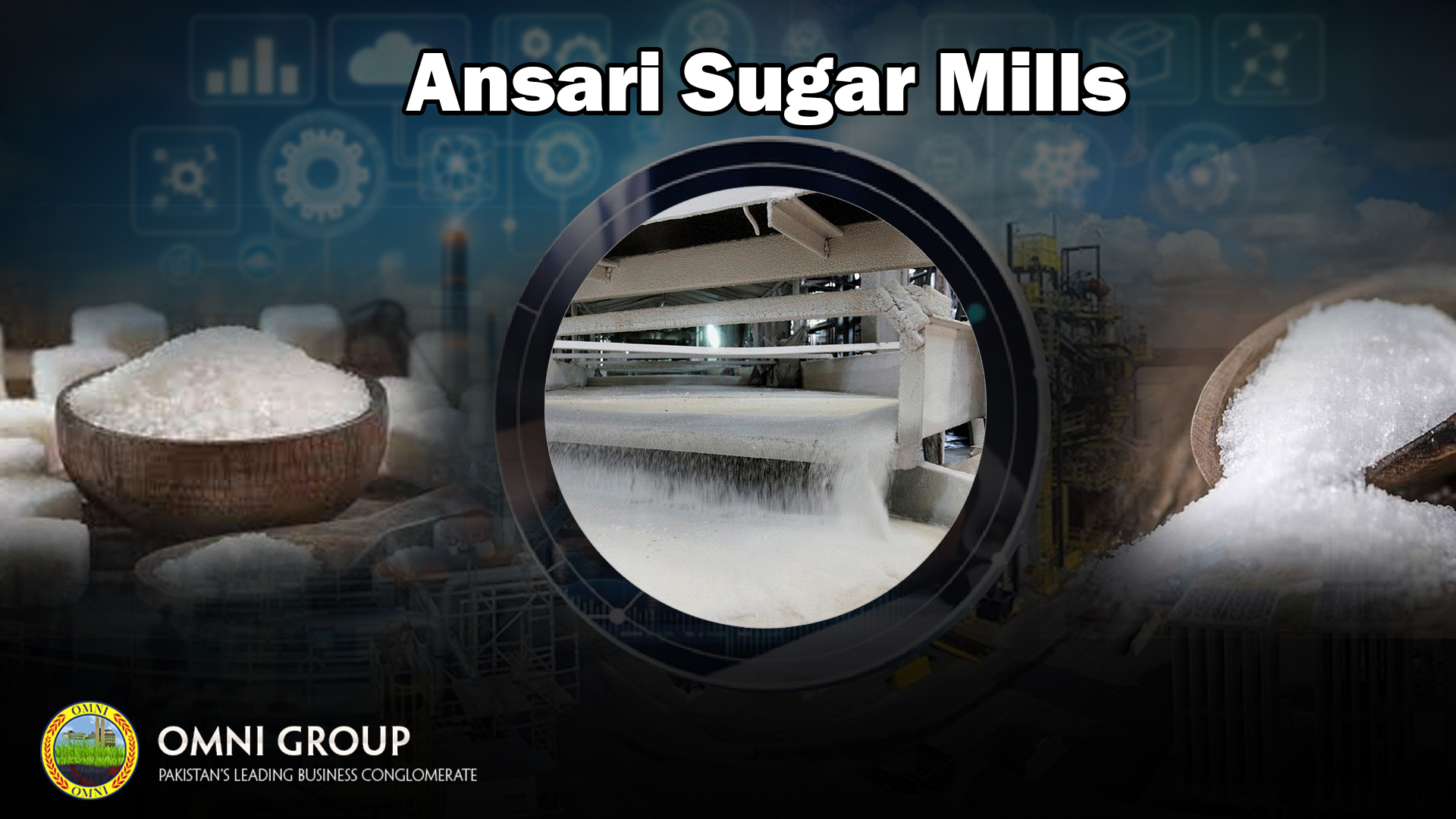

While I cannot provide a deep dive analysis without access to Ansari Sugar Mills’ financial data, this article can serve as a guide for what such an analysis might entail.

Key Metrics to Analyze

Financial performance analysis involves evaluating a company’s financial health through various metrics. Here are some key aspects to consider for Ansari Sugar Mills:

| Metric | Description |

|---|---|

| Revenue | Measures the company’s overall sales growth over time. An upward trend in revenue indicates sales growth, while a downward trend suggests a decline in sales. |

| Profitability | Analyzes how efficiently the company generates profit from its sales. Key profitability metrics include gross margin, operating margin, and net profit margin. Higher margins indicate better profitability. |

| Debt and Liquidity | Evaluates the company’s ability to pay its debts and financial obligations. This involves analyzing debt levels, debt-to-equity ratio, and cash flow. A lower debt-to-equity ratio and healthy cash flow indicate better financial stability. |

| Return on Investment (ROI) | Measures the company’s efficiency in generating profits from its investments. A higher ROI indicates better utilization of investments. |

Export to Sheets

Data Sources

To conduct a thorough financial performance analysis, you would need to gather data from various sources, including:

- Ansari Sugar Mills’ annual reports

- Financial databases like Bloomberg or Reuters

- Industry reports and publications

Growth Trends

By analyzing the metrics mentioned above over a period, you can identify growth trends in Ansari Sugar Mills‘ performance. This analysis would help assess the company’s effectiveness in its strategies and its position within the sugar industry. Here are some questions to consider:

- Is the company’s revenue growing steadily?

- Are profitability margins increasing or decreasing?

- Is the company managing its debt effectively?

- Is the company generating a good return on its investments?

Conclusion

A financial performance analysis of Ansari Sugar Mills would provide valuable insights into the company’s financial health, profitability, and growth trajectory. This information can be useful for investors, creditors, and other stakeholders in making informed decisions.Show the code behind this result